Difference between revisions of "Taxes"

(Text replacement - "{{#CustomTitle:" to "{{DISPLAYTITLE:") |

|||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | {{ | + | {{DISPLAYTITLE:VAT and other taxes}} |

| − | + | You manage VAT and other taxes via the menu options '''Sales''' and then '''Taxes'''. | |

| − | You | + | You can set up several '''tax groups'''. The default is a maximum of 3 groups, but you can increase this easily if needed. |

| − | + | [[File:Taxes.png]] | |

Typically you will require: | Typically you will require: | ||

| Line 18: | Line 18: | ||

* The account used to track the amount of tax | * The account used to track the amount of tax | ||

| − | Having created the different tax categories you need, you can move to managing sales [[SalesCategories | + | [[File:Tax.png]] |

| + | |||

| + | Having created the different tax categories you need, you can move to managing sales [[SalesCategories|Sales categories]]. | ||

For each sales category, and for each tax group, you can specify whether the tax should be applied or not, whether adding tax is mandatory, and whether a tax amount should automatically be calculated and added. | For each sales category, and for each tax group, you can specify whether the tax should be applied or not, whether adding tax is mandatory, and whether a tax amount should automatically be calculated and added. | ||

| Line 26: | Line 28: | ||

We hope that this system is flexible enough to accommodate the tax regimes and varied fiscal regulations of most countries. However, if it does not fit the situation where you live do not hesitate to contact the developers so it can be amended to suit your needs too. | We hope that this system is flexible enough to accommodate the tax regimes and varied fiscal regulations of most countries. However, if it does not fit the situation where you live do not hesitate to contact the developers so it can be amended to suit your needs too. | ||

| + | == In case a rate is changed == | ||

| + | |||

| + | You can't modify the rate of an existing tax, when it is referenced by an invoice line. This is required to keep the history and allow fiscal and accouting reports. | ||

| + | |||

| + | You have to create a new tax, with a new code and a new account. The day the new rate is starting, make it the defaut tax in it's tax group, and attach products and sales categories to the new tax if there was exceptions. | ||

[[Paramétrage_de_la_facturation | Billing Other settings]] | [[Paramétrage_de_la_facturation | Billing Other settings]] | ||

Revision as of 19:17, 11 February 2020

Français Español

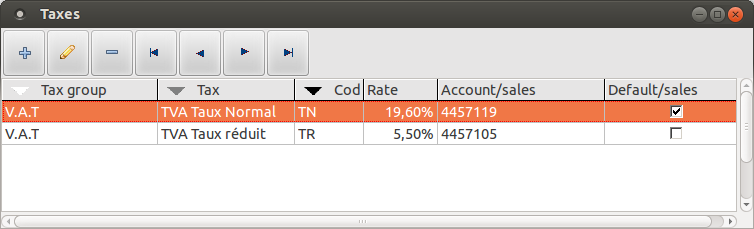

You manage VAT and other taxes via the menu options Sales and then Taxes.

You can set up several tax groups. The default is a maximum of 3 groups, but you can increase this easily if needed.

Typically you will require:

- A group for VAT

- One (or two) groups for other taxes

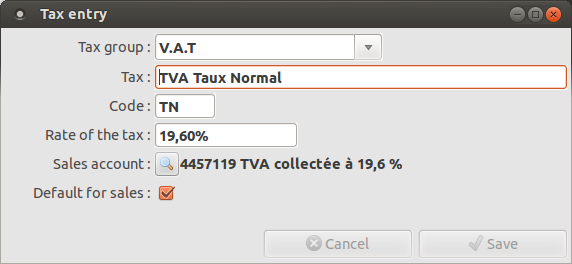

Each tax group allows for the definition of:

- The name of the tax

- An abbreviation for the tax (perhaps a short code) which is then printed on each invoice line requiring it

- The tax rate

- The account used to track the amount of tax

Having created the different tax categories you need, you can move to managing sales Sales categories.

For each sales category, and for each tax group, you can specify whether the tax should be applied or not, whether adding tax is mandatory, and whether a tax amount should automatically be calculated and added.

These settings will be used for each product and sales category. You can specify exceptions to the settings if needed.

We hope that this system is flexible enough to accommodate the tax regimes and varied fiscal regulations of most countries. However, if it does not fit the situation where you live do not hesitate to contact the developers so it can be amended to suit your needs too.

In case a rate is changed

You can't modify the rate of an existing tax, when it is referenced by an invoice line. This is required to keep the history and allow fiscal and accouting reports.

You have to create a new tax, with a new code and a new account. The day the new rate is starting, make it the defaut tax in it's tax group, and attach products and sales categories to the new tax if there was exceptions.